15 November 2021

The Texas Big Freeze

by Phillip Moretti & Aaron Prefontaine

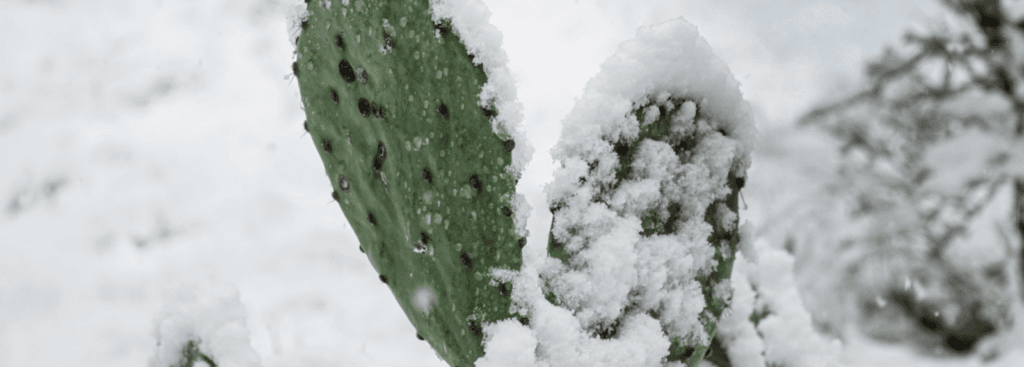

In February 2021, Texas USA experienced an unprecedented electricity and natural gas supply crisis caused by a series of severe winter storms. Prolonged electricity blackouts left millions of homes powerless for days as temperatures plunged as low as -19ºC, the coldest in the state for 70 years. These conditions and the 14-day duration of the freeze were completely unforeseen.

Outages led to shortages of heating, food and water and at least 210 deaths. The storms, extreme cold and utilities curtailments triggered an estimated US$20.4 billion* of claims. But blame for the devastation went beyond the storm itself. Texas’s power grid and energy firms were judged to be poorly prepared for the extreme conditions and criticised for responding inadequately. The crisis produced a high number of personal and business insurance claims, and Integra loss adjusters were appointed to assist with a wide range of incidents across the state.

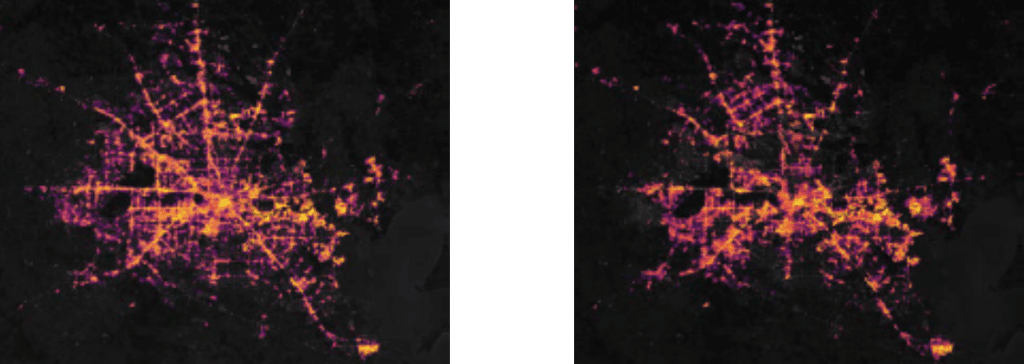

Satellite images of Houston before and after the storm. The dark patches in the right image depict areas left without electricity

Rapid on-the-ground assessment from Integra

Integra quickly deployed a team of expert, locally based adjusters with a broad portfolio of technical skills. Over

35 separate incidents were inspected across multiple locations, mostly energy assets, commercial property and manufacturing sites. In many instances in person inspections were hampered by Covid imposed restrictions on access.

We employed our IRIS (Integra Remote Inspection Solution) technology to provide fast, early-stage damage assessments. With IRIS, any representative of the insured can enable an on-site inspection using their smartphone under the guidance of a remotely located Integra loss adjuster. This gave our adjusters prompt, real-time visibility of damage and extra bandwidth to assess numerous sites concurrently. By leveraging our expertise both on site and virtually, we were able to quickly evaluate the extent of damage, speed up mitigation activities and adjust claims worth over US$1.5billion.

Loss adjusting considerations

1. The correct interpretation of wording

Service interruption (SI) is the interruption of utility services such as electric, gas or water caused by an insured event at a service provider’s property. SI can lead to business interruption (BI) and a range of other outcomes. Key to claims assessment is an understanding of whether business interruption results from service interruption or from other causes.

In the case of the Texas ‘Big Freeze’, it was vital to evaluate the exact sequence of events. Did service interruption

occur due to an imbalance of supply and demand during an unprecedented extended cold spell? Was the utility supply disrupted by physical damage to supplier assets? Also, events at the insured’s facility after loss of service required consideration. Would physical damage have occurred regardless of service interruption? And if so, what was

the type of damage, and did it stand alone

from a coverage perspective?

2. How many events actually occurred?

What exactly constitutes an ‘event’? This is an elementary but pivotal question. Which regulatory agency is responsible for declaring a Winter Storm? Are conditions deemed an event when named (in this case ‘Uri’) or when defined as an

‘atmospheric disturbance’ (typically a transient atmospheric event lasting a few days)? And in either case, what triggers the insurance policy? What is the relevance to a “72 Hours” clause?

The Weather Channel names storms to raise awareness and protect people and property, but it is neither a governing nor a regulatory agency. There are no set regulatory criteria for defining a winter storm. Instead, definition is simply based upon the anticipated impact on the local population. During the eight days preceding winter storm Uri, there were four other named storms (Quaid, Roland, Shirley and Tabitha) and at least one unnamed atmospheric disturbance. Typically, the naming of storms is not considered when handling these types of claims.

3. Energy price spike claims

Energy unit costs are subject to prevailing market conditions. During the events in February, limited energy supplies inflated prices by approximately 800%. These hikes in energy costs

(both natural gas and electricity) triggered more insurance claims. One key question is whether insureds could have decided not to operate at this time and so avoid incurring the increased costs? Would they have been exposed to these high energy costs even if they had not made a claim?

4. Were freeze plans fit for purpose?

Most insureds had ‘freeze plans’ which were tested in the summer and autumn. However, many of these did not anticipate such a sustained and severe event. Disaster response strategies often require time to implement,

and proved difficult to roll out when there was insufficient warning. For example, one plan called for production furnace temperatures to be reduced over a 24-hour period to avoid damage, but utility providers gave minimal notice, if any, of the interruption and cessation of supply.

A spider’s web of complexity

In all, the Texas ‘Big Freeze’ event precipitated a spider’s web of complexity that created many investigative and adjustment challenges for all concerned. Multiple claims across dispersed locations with interconnected causations required rapid and thorough technical assessment by Integra’s adjusting teams and technologies, which in some cases are ongoing.

A future of heightened risk?

According to the World Meteorological Organisation, the global weather is becoming more hazardous and less predictable. The years 1970 to 2019, saw over 11,000 extreme water and weather-related events and a five-

fold increase in weather-related disasters. Scientists point to climate change as the major culprit. With global temperatures set to rise further, it seems that catastrophic events like the Texas ‘Big Freeze’ may become more common. Science is telling us to expect a need for more robust infrastructure and a future of heightened risk.

Texas Power Crisis – February 2021

| Date | February 10th-27th, 2021 |

| Type | Statewide power outages, food/water shortages |

| Cause | Multiple severe winter storms |

| Deaths | 201* |

| Property damage | US$20.4billion** |