15 November 2021

ESG and its growing impact on the insurance industry

by Paul Latimer

Environmental, social and governance criteria – ESG, or sustainability, as it is also known – are key drivers for long-term company investment and infrastructure policies. No longer a ‘tick-the-box’ exercise, regulatory frameworks to establish ESG credentials for all sectors are being formulated worldwide.

This has, and will continue to have, a significant impact on the insurance sector.

What is ESG?

Company policy must consider these criteria:

ENVIRONMENTAL

How a business interacts with the natural environment Waste and pollution, resource depletion, greenhouse gas emissions, deforestation and climate change.

SOCIAL

How a company treats people Employee relations and diversity, working conditions, child labour and slavery, impact on local communities, and funding projects serving poor and underserved communities globally.

GOVERNANCE

How a corporation is governed and polices itself.

Tax strategy, executive remuneration, donations and political lobbying, corruption and bribery, board diversity and structure.

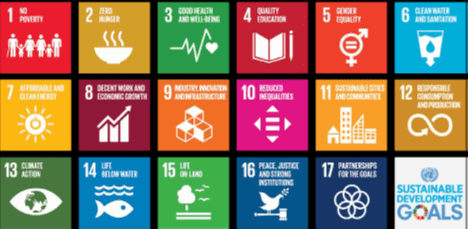

17 sustainable development goals (SDGs) were adopted by UN member states in 2015. These are designed to transform our world with a universal call to action to end poverty, protect the planet and improve the lives and prospects of everyone, everywhere.

How is ESG policed?

Most major ‘westernised’ countries are committing to cut greenhouse gas emissions, rapidly reduce renewable energy costs and effect social change. The UN-backed global initiative Principles for Responsible Investment (PRI) was launched in 2006. Aimed at creating a sustainable financial system, it now has over 3,000 signatories.

The UK was the first G7 country to legally formalise the target of becoming a net zero carbon area by 2050. The current administration’s ten-point plan for a “green industrial revolution”, involves £12 billion of public spending.

The US has re-joined the Paris Agreement on climate change and is prioritising reaching net-zero greenhouse gas emissions by 2050. The US power sector should be decarbonised by 2035.

Regulatory frameworks will be used to guide project/asset management and risk management going forward. However, data is sketchy with a patchwork of reporting frameworks around the world. Standardisation is lacking and regulators are being forced to address this.

Companies are facing regulatory and investor pressure to give ESG policy greater weight in decision-making and strategy or face long-term negative consequences. However, greenwashing is on the increase.

How does ESG affect the insurance sector?

Climate, natural catastrophe, extreme weather and fire remain the main causes of insurance claims in the property and construction sectors in the long term. This is before the impact of the pandemic, which has not yet been

fully assessed.

New ESG-led regulations will mean less demand for coal, oil and gas over the coming decades, potentially making some uninsurable in the long term. Having initially focused their efforts on integrating ESG filters into asset management activities, insurers are now looking at the underwriting side of the business.

Major insurers are implementing ESG frameworks that will limit their appetite for non-ESG risks and employing ESG experts to oversee this. New start-ups like Parhelion aim to offer green and sustainable insurance, arguing that without ‘green’ insurance company supply chains will not be

fully sustainable.

How can insurers lead by example?

Insurers should be considering how to help clients with sustainability initiatives and providing new products. Lloyd’s is embracing ESG with a leadership role. The Sustainable Markets Initiative (SMI) Insurance Task Force was convened by HRH Prince of Wales and chaired by Lloyd’s to be an “influential platform for the sector to collectively advance the world’s progress towards a resilient, net-zero economy”.

For underwriting, ESG means a drive to a low-carbon global economy. There is increasing pressure not to underwrite certain exposures. New strategies will be needed to insure fossil fuel assets, for example, as public opinion and ESG requirements make it harder.

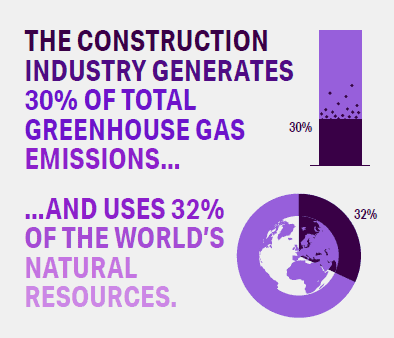

The construction industry generates 30% of total greenhouse gas emissions and uses 32% of the world’s natural resources. The cumulative volume of construction is expected to reach US$212 trillion by 2030. As the largest contributor to climate change, the construction industry will need to make the greatest reductions.

Companies that ignore ESG will lose relevance and market position. To maintain credibility they must act before being forced to.

How will loss adjusters need to adapt?

Loss adjusters will need to advise on rectification works that comply with client ESG criteria and current regulations. They will need to know what is “equivalent” and what would be “betterment” and interpret

cover accordingly.

A robust due diligence process from risk assessment to claim fulfilment will be key.

What will the future bring?

While ESG-assessed risk only accounts for a small percentage of the market currently, it is becoming increasingly significant.

The time to act is now